Learn how to optimize your inventory with our Inventory Days On Hand Calculator below. This guide offers different methods for calculating DOH, tips for improving accuracy, and best practices for maximizing efficiency within your organization. Get reliable data and make better-informed decisions for your stock levels today!

Days Inventory On Hand Calculator Guide

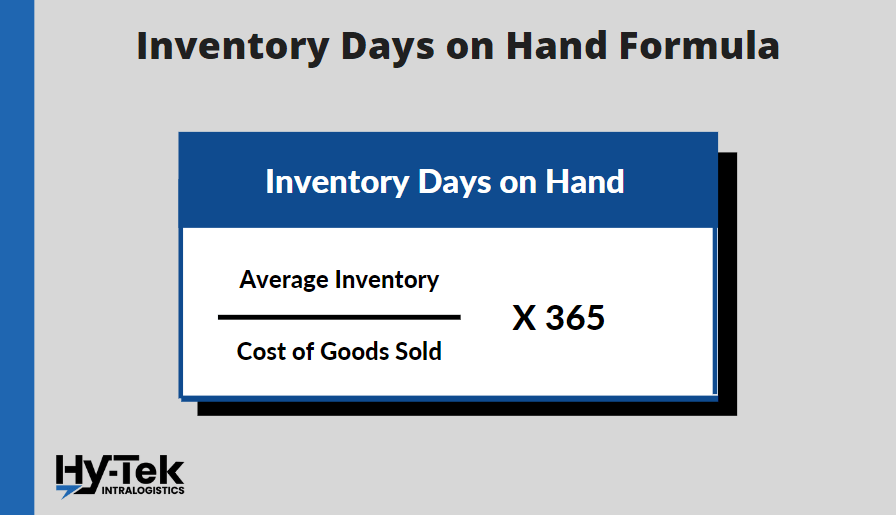

A Days on Hand (DOH) Inventory calculator can help determine how long your inventory will last based on your current sales and stock levels. To use the calculator, you need to enter three key pieces of information:

- Average Inventory: This is the average value of your inventory over the accounting period. You can calculate this by adding up the value of your inventory at the beginning and end of the period and dividing it by two.

- Cost of Goods Sold: This is the total cost of the items you sold during the accounting period. You can find this information on your income statement.

- Days in the Accounting Period: This is the number of days in the accounting period. You can calculate this by subtracting the start date from the end date and adding one. Typically, this is done yearly, so you will use 365 days.

Once you have entered these values into the DOH Inventory calculator, it will give you the number of days of inventory you have on hand. This number represents the days it would take to sell your inventory based on your current sales rate. The lower the number of days, the better, as it means you have less inventory tied up in your business and can make room for new products or reduce your costs.

Other Important Inventory KPIs

- Inventory Turnover Rate: Knowing your inventory turnover rate is crucial for efficient inventory management and maintaining healthy cash flow.

- Inventory Accuracy: Knowing your inventory accuracy is essential for making informed business decisions, avoiding stockouts, reducing excess inventory, and ultimately maximizing profits.

View our List of the Top 30 Warehouse KPI Metrics

What Is Inventory Days On Hand

Inventory Days on Hand is a metric of how many days a business takes to sell through its inventory. It’s a key indicator of inventory management efficiency, which is important for financial analysts and investors evaluating a company’s performance.

The calculation uses several key metrics: inventory turnover ratio, average inventory value, and days sales outstanding (DSO).

The first metric measures the frequency with which a business sells its existing stock; if it is high, there’s frequent sales activity. The second metric evaluates the total dollar amount of goods sold each fiscal year; if higher than usual revenues are generated, this could indicate better stocking decisions have been made. Lastly, DSO looks at how quickly customers pay their invoices; this suggests good cash flow management if timely payment is made.

These three metrics help paint a picture of how effectively products, raw materials, or services move through the organization – from acquisition to sale.

By understanding trends in each component of the equation, we can get closer to our goal of optimizing inventory levels while ensuring customer satisfaction remains high. With actionable insights derived from an effective DIOH calculator, companies can make informed decisions about when and what type of items need to be stocked for maximum efficiency and profitability.

What Does A Good Days Inventory On Hand Look Like?

A good days inventory on hand typically ranges from 45 days or less. This indicates that a company is efficiently managing its inventory and not tying up too much capital in stock. However, the ideal number can vary depending on the industry, seasonality, and other factors, so it’s crucial to analyze it in context.

Ultimately, a good days inventory on hand is one that allows a company to meet customer demand while minimizing inventory holding costs and maximizing profitability.

Factors That Can Affect Your Days Inventory On Hand

When it comes to calculating inventory days on hand, there are a few factors that can affect the outcome. These include inventory levels, financial ratios, working capital, and existing and future inventory levels. Knowing how these elements contribute to your ending inventory is key to understanding how to calculate and optimize your days of inventory on hand.

Inventory Levels

Inventory levels are an important factor when considering days of inventory on hand.

If your current stock levels are higher than the average for a particular product or service, this can lead to higher inventory turnover and more days in holding costs. Likewise, if you’re running low on certain items, you may have fewer days of inventory since you must convert incoming orders faster.

Financial Ratios

Financial ratios also play an essential role in determining your days of inventory on hand as they indicate how efficiently your business manages its assets.

For example, the cash conversion cycle ratio measures the time between ordering and selling goods – shorter cycles mean fewer days the company holds for each item sold. Additionally, high liquidity ratios demonstrate that businesses have enough resources to cover their short-term liabilities, which further impacts their ability to pay down debt quicker and thus reduce overall costs related to maintaining existing inventories.

Working Capital

Finally, working capital plays a major part in calculating your day’s worth of inventory, too; companies need sufficient funds available at all times to purchase new goods and services while still keeping up with payment commitments towards suppliers and creditors alike.

Having ample working capital means greater flexibility when converting inventories into sales quickly without incurring additional expenses.

All in all, it’s important to understand each one of these components before attempting to calculate your Days Inventory On Hand (DIOH) accurately. Considering these three main factors when managing your DIOH, you can significantly improve efficiency and cost savings across different inventories within a single system.

Tips To Improve Your Days Inventory On Hand

It’s a simple equation: more inventory turnover means better days sales. But how do you go about optimizing this critical metric? Here are a few tips to start you on the path to perfecting your inventory cycles!

- Monitor inventory levels regularly to identify excess or insufficient stock

- Analyze trends in inventory performance to identify patterns and make informed decisions

- Use forecasting models and automated replenishment systems to optimize order quantities and minimize losses due to overstocking or understocking

- Train employees on the importance of accurate data collection, timely updates, and proper storage techniques to increase efficiency and reduce costs

- Implement just-in-time inventory management to reduce inventory levels and improve cash flow

- Conduct regular inventory audits to ensure accuracy and minimize discrepancies

- Work closely with suppliers to improve lead times and reduce order processing times

- Consider implementing a centralized inventory management system to improve visibility and control over inventory levels

- Develop and implement a clear inventory management strategy to guide decision-making and ensure consistency.

While these tips may not guarantee success overnight, following them will put you well on your way toward achieving increased profitability through optimized days inventory on hand. And who doesn’t want that?

Conclusion

Having a good understanding of your Days Inventory on Hand is paramount to success in the inventory world. It’s like having an extra set of eyes that can help you see what areas need improvement and where you should focus your resources for maximum efficiency.

The key to optimizing this metric is accurately calculating it and then taking actionable steps to improve any weaknesses or discrepancies between current levels and desired outcomes. To do this, consider customer demand, supplier performance, financial ratio, product availability, technological capabilities, and more. Considering these will help you create strategies tailored specifically to your business needs and goals.

Finally, remember that a healthy Days Inventory on Hand balance acts like a ship’s anchor – providing stability amidst the ever-changing tides of supply chain waters. With consistent monitoring and smart decision-making, you’ll stay afloat no matter how choppy the seas get!

FAQ

What is a good days of inventory on hand?

A good inventory days on hand is usually 30 days or less, indicating efficient inventory management and reduced capital investment. However, industry, seasonality, and other factors should be considered for an ideal number.

What is the difference between inventory turnover and days inventory outstanding?

Inventory turnover measures how quickly a company sells its inventory, while Days Inventory Outstanding (DIO) calculates the average number of days it takes to sell its inventory.

How do I calculate days in inventory in Excel?

To calculate days in inventory in Excel, use this formula: (Average Inventory / Cost of Goods Sold) x Number of Days in the Period. Determine the average inventory using the AVERAGE function, calculate the cost of goods sold from the income statement, and determine the number of days in the period. For example: = (AVERAGE(B2:B13) / C2) * 365, where B2:B13 contains inventory values, and C2 is the cost of goods sold. Ensure the units match or convert them before using the formula.